Man,

It may be the night before Thanksgiving, but its beginning to feel a lot like Christmas!

The U.S. is absolutely crushing it in the trade war with China. For those that said the tariffs were bad and would hurt if not crush the U.S. economy, you've been proven wrong. China, not the U.S. consumer, has paid.

Have there been any casualties on our side? Yes. The Agriculture industry in particular has been hurt. Overall though the net/net has been extremely positive for us and let's face it, China needs our food. And as much as I hate it for any that have been hurt this is a trade war, and wars do have casualties.

Trump is certain enough that China needs U.S. Ag and doesn't care about the "rest of the deal" that he threw some more sand in their face today, which was also the right thing to do. How mad do you think Xi is gonna be over Hong Kong? Very! But, Trump obviously doesn't care. Why? Because he doesnt see anything that he has to lose. I think he's right.

https://www.foxnews.com/politics/trump-signs-hong-kong-support-bill-rebuke-to-china

Oh and the next screw that will be turned is USMCA. And that might just be happening quicker than I thought once Trudeau was re-elected. Seems that Nancy may not be able to try and keep the economy down like she would like to for as long as she would like to. There is just too much pressure on her as impeachment is falling apart right before her very blood shot eyes!

https://theconservativetreehouse.com/2019/11/27/bartiromo-usmca-could-come-up-for-vote-next-week/

The wheels will keep turning and things will keep progressing, and there really isn't anything that Xi or Pelosi can do to stop it.

President Trump China Strategy: Death By a Thousand Paper Cuts…

Posted on

November 27, 2019 by

sundance

The New York Federal Reserve made a quiet admission two days ago that was missed by almost all financial media. In the NY Fed economic blog they admitted everyone was wrong,

President Trump’s 2017 tariffs against China did not lead to increased U.S. consumer prices [

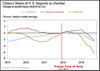

Read Here]. The Fed also said imports of the Chinese products affected by U.S. tariffs have fallen by an annualized $75 billion. That’s a huge chunk of business U.S. purchasers have shifted to Japan and other Southeast Asian countries.

.

Within this dynamic lays the real reason why Beijing cannot wait for a 2020 election hoping that Biden or Bloomberg can stop their bleeding. Before going into more depth, this brief explainer from Charles Payne will help establish a framework. WATCH:

What Payne outlines is correct; however, the internal Chinese ‘tariff-offset’ dynamic is actually even a little deeper. Overlaying the NY Fed research we can see that Beijing has attempted to offset the Trump tariffs in four majority ways:

- A devaluation of their currency by roughly 10% since the tariffs were implemented. This makes the dollar a higher value when purchasing. The U.S. dollar purchases more stuff.

- Direct subsidies by the communist control authority. That is a direct payment to the exporting Chinese company to offset the drop in prices they may need to be competitive.

- Indirect subsidies. Remember, China is a communist system. Beijing can tell a province to cancel the electricity bill to a company within that province. Beijing absorbs the cost.

- Incentives for enhanced end-product delivery. As Payne noted in the video the Chinese company just give the purchaser more stuff at the same price. That additional stuff offsets the tariff cost. This free stuff shows up in new contract terms.

All of this is an effort by China to diminish the impact of U.S. tariffs against their exports. However, all of this cumulative effort, while small in the individual pieces, when added up is a big economic cost to Beijing. Thus the overall economic loss is starting to snowball as the accumulation of offsets is beginning to aggregate. They cannot continue indefinitely.

China is suffering a slow death by a thousand paper-cuts. The bleeding of cash in combination with the direct loss of $75 billion in annualized exported products that U.S. companies have now sourced from alternative ASEAN nations is biting hard.

The direct outcome is also a drop in China’s purchasing of industrial goods they would normally use in the manufacturing process. This lack of Chinese purchasing is one of the top reasons for the stall in the European economy.

There is a natural lag as supply chains reorient. The ASEAN nations that have picked up U.S. manufacturing contracts first go through a process of increased productivity, expanded utilization of existing manufacturing, before they need to expand to new facilities. Machines operate 20 hours daily – instead of 16 hours; more shifts are added, etc. Until production reaches 100% capacity no ASEAN group is going to purchase the warehoused industrial machinery, not purchased by China, and being stored in the EU.

In this investment, lending and financing dynamic, is where the current Wall Street multinational corps and banks are stalled and watching closely. No-one wants to drop $100 million to help expand a textile company in Vietnam, if Mexico -via the USMCA- ends up being a more cost efficient location. This status is why passage of the USMCA is an important next step for President Trump’s global trade reset.

A final word on a question often asked. What is President Trump doing with the trade negotiations with China? What’s his end?

The answer to that question is actually where one must overlay Trump’s history of energy policy, with the visible signs of his China trade reset that began with his visit to Southeast Asia in November 2017.

President Trump is famously impatient in achieving a financial objective. He is known to have well thought plans, but he is also known to not pause long when executing his plan. This economic impatience may seem to be at odds with the majority of the financial media who say President Trump is playing a long-game with Chairman Xi Jinping.

ERGO the dichotomy is explained thus: If President Trump is famously impatient, then why is he being so deliberate and painfully slow in achieving a deal with Chairman Xi?…

Here’s the ‘ah-ha’ moment.

….The current status with China was the final objective.

President Trump looks like he’s being stunningly patient because President Trump achieved his goal when no-one was paying attention. We are already past the success point.

The goal is essentially achieved.

There is no actual intent to reach a trade deal with China where the U.S. drops the tariffs and returns to holding hands with a happy panda playing by new rules. This fictional narrative is a figment of fantasy being sold by a financial media that cannot fathom a U.S. President would be so bold as to just walk away from China.

That ‘walk away’ is exactly what President Trump did when he left all of those meetings in Southeast Asia in 2017; and every moment since has been setting up, and firming up, an entirely new global supply chain without China.

President Trump is not currently engaged in a substantive trade agreement in the formal way people are thinking about it. Instead “Phase-One” is simply President Trump negotiating the terms of a big Agricultural purchase commitment from Beijing, and also protecting some very specific U.S. business interests (think Apple Co.) in the process.

The actual goal of President Trump’s U.S-China trade reset is a complete decoupling of U.S. critical manufacturing within China.

President Trump does not express angst, frustration, or even disappointment over the U.S-China trade discussions because the decoupling is well underway.

.

Happy Thanksgiving !

Donald J. Trump

✔@realDonaldTrump

New Stock Market Record today, AGAIN. Congratulations USA!

49.9K

4:09 PM - Nov 27, 2019

Twitter Ads info and privacy

15.3K people are

https://theconservativetreehouse.co...y-death-by-a-thousand-paper-cuts/#more-177194